Luxury Watch Investment 101: A Beginner’s How-To

Key Highlights

- Luxury watches make great investment options, as they often maintain or increase in value over time.

- When investing in luxury watches, it is important to consider factors such as brand reputation, scarcity, and condition.

- Researching the market and setting realistic investment goals are essential before making your first luxury watch purchase.

- Trusted retailers, auction houses, and online marketplaces are some of the places where you can buy and sell luxury watches.

- Proper maintenance and care, including regular servicing and insurance, are important for preserving the value of your investment watches.

Introduction

Investing in luxury watches has become increasingly popular in recent years. With international brands backing them, luxury timepieces often maintain or even increase in value over time, making them an excellent investment option. From classic collectibles to rare limited editions, luxury watches embody style, prestige, and craftsmanship.

However, investing in luxury watches requires a certain level of knowledge and understanding. It’s important to consider factors such as brand reputation, scarcity, and condition before making a purchase. Researching the market, setting realistic investment goals, and knowing where to buy and sell watches are also crucial.

In this beginner’s guide to luxury watch investment, we will explore the allure of luxury watch investing, the value of timepieces beyond just being timekeepers, and how to prepare for your first luxury watch investment. We will also provide a step-by-step guide to investing in luxury watches, highlight top luxury watch brands for investment, and discuss where to buy and sell luxury watches. Additionally, we will provide tips on maintaining your watch investment and answer frequently asked questions about luxury watch investment.

The Allure of Luxury Watch Investing

The luxury watch market has always been known for its exclusivity and craftsmanship, which are key factors that contribute to the allure of luxury watch investing. Luxury watches are not only timekeepers but also symbols of status and style. Their limited production numbers and high demand make them an excellent investment choice for those looking to diversify their investment portfolio with tangible assets.

Understanding the Value of Timepieces

Luxury watches hold value beyond just telling time. They are considered valuable for many reasons, including their brand reputation, craftsmanship, and scarcity. A luxury timepiece represents a piece of art and a symbol of status. The value of a watch is influenced by various factors, such as the brand, materials used, condition, and desirability among collectors.

Investing in luxury watches can be a good long-term investment strategy if done wisely. While not all luxury watches will appreciate in value, certain brands and models have a track record of holding or even increasing their value over time. It is important to research the market, follow industry trends, and consider the historical performance of specific watch models before making an investment.

Why Watches Are More Than Just Timekeepers

Luxury watches offer more than just timekeeping functionality. They are often crafted with intricate details and features that showcase the artistry and technical expertise of watchmakers. Mechanical watches, in particular, are highly sought after for their precision and craftsmanship.

Luxury watch brands, such as Rolex, Patek Philippe, and Audemars Piguet, are known for their attention to detail, quality materials, and exceptional design. These brands have built a reputation for producing timepieces that not only serve as status symbols but also hold their value in the market.

From complications like chronographs and moon phases to unique dial designs and high-quality movements, luxury watches offer a combination of functionality and aesthetics. Owning a luxury timepiece allows individuals to express their personal style and appreciation for fine craftsmanship.

Preparing for Your First Luxury Watch Investment

Before diving into luxury watch investments, ensure you have the right tools and knowledge. Research the market trends, understand the significance of different luxury watch brands like Rolex and Patek Philippe, and set achievable investment goals. This includes learning about limited edition pieces, the resale value of top brands, and the importance of watch condition and authenticity. By familiarizing yourself with these key aspects, you’ll be better equipped to make informed and successful luxury watch investments.

Essential Tools and Resources for Beginners

As a beginner in luxury watch investment, essential tools and resources can pave the way for successful ventures. Start by exploring reputable dealers, online platforms, and auction houses to expand your options. Utilize market insights from NLP to grasp trends and identify valuable pieces. Understanding terms like “limited edition” or “resale value” arms you with vital knowledge. Research specific models from top brands like Rolex and Patek Philippe to gauge investment potential. Arm yourself with these tools to make informed decisions in this lucrative market.

Setting Realistic Investment Goals

Setting realistic investment goals is crucial when investing in luxury watches. Consider the following factors when setting your investment goals:

- Best investment watches: Research and identify watches that have a history of holding or increasing in value. Look for limited editions, iconic models, and watches from reputable brands.

- Personal preference: Invest in watches that align with your personal taste and style. This will ensure that you enjoy wearing and owning the timepieces, even if their value fluctuates in the market.

- Market demand: Consider the current and potential future demand for the watches you are interested in. Highly sought-after models are more likely to hold their value or appreciate over time.

By setting realistic investment goals, you can make informed decisions and build a watch collection that aligns with your personal preferences and financial objectives.

Step-by-Step Guide to Investing in Luxury Watches

Investing in luxury watches requires careful consideration and planning. Follow this step-by-step guide to make informed decisions and maximize your investment potential.

Step 1: Researching the Market

Before making any investment, it is important to research the luxury watch market. Stay updated on the latest trends, market fluctuations, and new releases from luxury watch brands. Consider the historical performance of specific watch models and brands to identify potential investment opportunities. Research reputable dealers and auction houses that specialize in luxury watches. By understanding the market, you can make informed decisions and identify watches that have the potential to increase in value over time.

Step 2: Identifying Investment-grade Watches

When investing in luxury watches, it is important to identify watches that are considered investment-grade. Consider the following factors:

- Limited edition: Limited edition watches are often more desirable and have the potential to appreciate in value due to their exclusivity.

- Stainless steel: Stainless steel watches from luxury brands such as Rolex and Audemars Piguet are highly sought after and tend to hold their value well.

- Resale value: Research the resale value of specific watches and brands. Watches with strong resale value are more likely to hold or increase in value over time.

By focusing on investment-grade watches, you can increase the likelihood of a successful investment.

Step 3: Evaluating Watch Condition and Authenticity

Evaluate the condition and authenticity of a watch before making a purchase. Consider the following factors:

- Good condition: Look for watches that are in good overall condition, including the case, dial, hands, and movement. Watches in better condition generally have higher value and are easier to resell.

- Watch authenticity: Verify the authenticity of the watch through reputable dealers, certification, and expert opinions. Counterfeit watches can lead to significant financial losses.

- Desired timepiece: Consider the specific features, model, and brand that you desire in a watch. Determine the market demand for that particular timepiece and evaluate its potential for appreciation in value.

By ensuring the condition and authenticity of a watch, you can make a more informed investment decision.

Step 4: Making Your First Purchase

When making your first luxury watch purchase, consider the following:

- Trusted retailers: Purchase from trusted retailers or authorized dealers to ensure the authenticity and quality of the watch.

- New watches: Consider buying new watches directly from the manufacturer to ensure the watch is in pristine condition and comes with warranties.

- Specific model: Focus on specific models that have a history of holding or increasing in value. Research the market demand and price trends for the specific model you are interested in.

By making a well-informed purchase, you can increase the potential for a successful investment.

Step 5: Managing Your Watch Portfolio

Once you have started building your watch portfolio, it is important to manage it effectively. Consider the following:

- Watch portfolio: Monitor the performance of your watch portfolio regularly and make adjustments as necessary. Stay informed about market trends and watch industry news.

- Long history: Watches with a long history and strong reputation often hold their value well. Consider adding vintage watches or watches from iconic brands to diversify your portfolio.

- Number of watches: Determine the number of watches you want to include in your portfolio based on your investment goals and budget. A diversified portfolio can help mitigate risk and maximize returns.

By actively managing your watch portfolio, you can optimize your investment and ensure long-term success.

Top Luxury Watch Brands for Investment

When it comes to luxury watch investment, certain brands have a strong track record of value appreciation. Consider these top luxury watch brands for investment:

- Audemars Piguet: Known for its iconic Royal Oak models, Audemars Piguet offers luxury watches with a history of holding or increasing in value.

- Richard Mille: Richard Mille watches are highly sought after for their innovative design, technical complexity, and limited production numbers.

- Omega Speedmaster: Omega Speedmaster watches have a rich heritage and are famous for their association with space exploration, making them popular among collectors.

Investing in watches from these brands can offer potential returns and satisfaction as a watch collector.

Brand 1: Rolex – A Timeless Choice

Rolex is one of the most iconic luxury watch brands and has a reputation for producing timeless and reliable timepieces. Consider the following Rolex watches for investment:

- Rolex GMT: The Rolex GMT-Master is a popular choice for investors due to its dual timezone functionality and timeless design. Models such as the GMT-Master II hold their value well and are highly sought after.

- Rolex Daytona: The Rolex Daytona is a legendary sports chronograph known for its high performance and classic design. Vintage Daytona models, such as the Paul Newman Daytona, are especially sought after and have seen significant appreciation in value.

Investing in Rolex watches can offer a combination of style, prestige, and potential financial returns.

Brand 2: Patek Philippe – The Epitome of Luxury

Patek Philippe is synonymous with luxury and craftsmanship. Consider the following Patek Philippe watches for investment:

- Patek Philippe Nautilus: The Patek Philippe Nautilus is a highly coveted sports watch known for its distinctive design and high-quality craftsmanship. Limited edition Nautilus models, such as the Nautilus 5711, are particularly valuable.

- Patek Philippe Calatrava: The Patek Philippe Calatrava is an elegant dress watch that embodies timeless style and refinement. Calatrava models in precious metals, such as white gold, are highly sought after by collectors.

Investing in Patek Philippe watches offers the opportunity to own a piece of horological history and luxury.

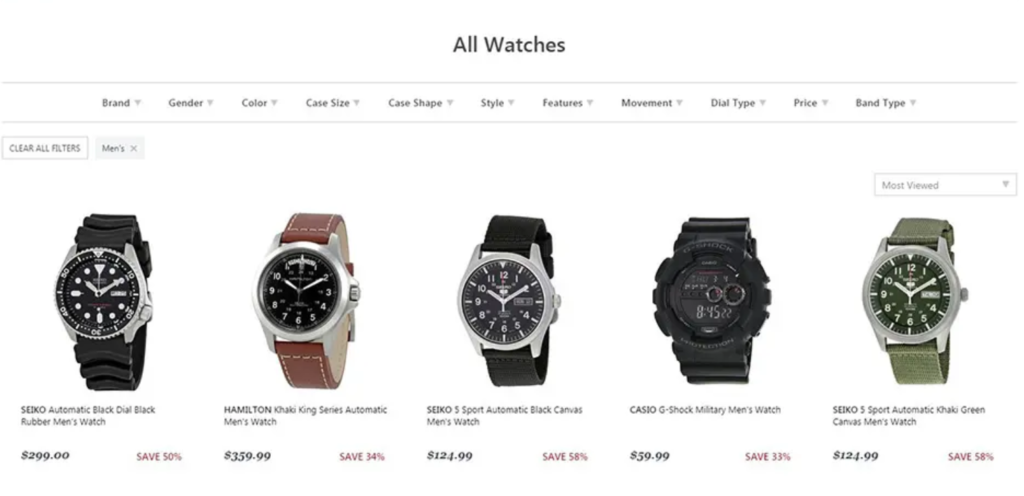

Where to Buy and Sell Luxury Watches

When it comes to buying and selling luxury watches, there are several options to consider. Explore the following avenues:

- Auction houses: Auction houses specialize in the sale of high-end watches and provide access to rare and collectible timepieces.

- Online marketplaces: Online platforms like Chrono24 and eBay offer a wide selection of luxury watches from various sellers.

- Reputable dealers: Trusted dealers and authorized retailers offer a curated selection of luxury watches and provide assurance of authenticity.

The United Kingdom is home to many reputable dealers and auction houses, making it a popular destination for luxury watch enthusiasts.

Trusted Retailers and Auction Houses

When buying or selling luxury watches, it is important to work with trusted retailers and auction houses. Consider the following:

- Reputable dealers: Trusted dealers have a track record of authenticity and can provide expert advice on the value and condition of a watch. They often have a curated selection of luxury watches and can guide you through the buying or selling process.

- Auction houses: Auction houses specialize in the sale of high-end watches and offer access to rare and collectible timepieces. They provide a platform for buyers and sellers to connect and facilitate transparent transactions.

Working with trusted retailers and auction houses ensures that you are investing in authentic watches and receiving fair value for your timepieces.

Navigating the Online Marketplace

Online marketplaces offer a convenient way to buy and sell luxury watches. When navigating the online marketplace, consider the following:

- Research the seller: Before making a purchase, research the seller’s reputation and read reviews from previous buyers. Look for sellers with a track record of positive feedback and a high rating.

- Verify authenticity: When buying a used watch online, ask for detailed photos and documentation of authenticity. If possible, have the watch authenticated by an expert before making a purchase.

- Compare prices: Use the online marketplace to compare prices and find the best deals. Keep in mind that prices can vary depending on the condition, rarity, and demand for a particular watch model.

The online marketplace offers a wide selection of luxury watches and can be a great resource for finding investment-worthy timepieces.

Maintaining Your Investment

Proper maintenance and care are essential for preserving the value of your investment watches. Consider the following:

- Regular service: Schedule regular servicing for your watches to ensure they are in optimal condition. This includes cleaning, lubrication, and inspection of the movement.

- Watch care: Protect your watches from scratches, moisture, and extreme temperatures. Store them in watch boxes or pouches and avoid exposing them to direct sunlight.

- Insurance: Consider insuring your investment watches to protect against loss, theft, or damage. Consult with an insurance provider specializing in valuable assets.

By maintaining your investment watches, you can extend their lifespan and preserve their value.

Regular Service and Care Tips

Regular service and care are crucial for keeping your luxury watches in good condition. Consider the following tips:

- Schedule regular servicing every 3-5 years to ensure optimal performance and longevity of your watches.

- Clean your watches regularly using a soft cloth or a specialized watch cleaning solution.

- Avoid exposing your watches to extreme temperatures, moisture, or direct sunlight.

- Store your watches in a watch box or pouch to protect them from scratches and dust.

- Wind automatic watches regularly to keep the movement running smoothly.

By following these service and care tips, you can maintain the value and functionality of your luxury watches.

Insurance and Security Considerations

Insurance and security are important considerations for protecting your investment watches. Consider the following:

- Insurance: Insure your watches against loss, theft, or damage. Consult with an insurance provider specializing in valuable assets to ensure adequate coverage.

- Security measures: Take precautions to secure your watches, such as installing a home security system, using a safe or vault, or keeping them in a secure location.

- Record keeping: Maintain detailed records of your watches, including purchase receipts, appraisals, and photographs. This documentation can be helpful for insurance claims or if your watches are ever lost or stolen.

By addressing insurance and security considerations, you can protect your investment and have peace of mind.

Conclusion

Luxury watch investment offers not just a financial opportunity but also a chance to own timeless pieces of art. Understanding the market, selecting reputable brands, and ensuring authenticity are paramount in this venture. By setting realistic goals, managing your portfolio, and caring for your watches, you can build a valuable collection. Remember to leverage trusted retailers or auction houses for transactions and prioritize regular servicing and insurance for protection. Whether you’re a seasoned investor or a beginner, the allure of luxury watch investment lies in its fusion of craftsmanship, history, and potential returns. Embark on this journey with knowledge, caution, and a keen eye for quality.

How Much Should I Invest in My First Luxury Watch?

The amount you should invest in your first luxury watch depends on your personal preference and budget. Consider starting with an initial investment that is comfortable for you and gradually expand your collection over time.

Can Luxury Watches Be a Primary Investment?

While luxury watches can be a valuable investment, they are not typically considered a primary investment. It is generally recommended to diversify your investment portfolio across different asset classes, including stocks, bonds, and real estate, to minimize risk and maximize returns.

What Are the Risks Involved in Watch Investing?

Watch investing, like any investment, carries certain risks. These risks include market fluctuations that can affect the resale value of watches, the potential for counterfeit watches in the market, and the risk of overpaying for a watch due to inflated prices.

How can I ensure the authenticity of a luxury watch before making a purchase?

Ensuring the authenticity of a luxury watch is crucial when making a purchase. Consider the following steps:

- Buy from a reputable dealer or authorized retailer.

- Verify the watch’s serial and model numbers with the manufacturer.

- Inspect the watch for quality craftsmanship and accurate markings.

https://www.bobswatches.com/new-arrivals

https://www.youtube.com/@NicoLeonard

https://www.instagram.com/prideandpinion/

https://www.vinovest.co/blog/are-watches-a-good-investmenthttps://wristcheck.com/discover/marketcheck/how-to-invest-in-watches:-five-experts-on-timepieces-that-will-hold-value-over-the-next-five-years

Leave a Reply